Picture an ordinary day, routine emails flooding your business inbox. Among them, a message from a trusted client or a seemingly innocuous query from an IRS email address. Responding swiftly, you unknowingly open the door to a significant data breach. What follows next is severe damage to your company’s reputation, erosion of customer trust, and financial losses that threaten sustainability. These are just some of the implications of ignoring the Federal Trade Commission (FTC) Safeguards Rule Compliance. Other implications include civil lawsuits and massive financial penalties.

It is thus essential for organizations to prioritize data security and implement effective safeguards to protect customer information.

What is FTC Safeguards Rule Compliance?

In the dynamic or ever-changing cybersecurity and data protection landscape, staying abreast of regulatory requirements is paramount for firms across various industries. One such crucial aspect is the FTC Safeguards Rule Compliance. Given that the FTC is a government agency that protects consumers from deceptive and illegal business practices, FTC safeguards rule compliance carries significant implications for businesses handling consumer data, including IT firms, CPA firms, and accounting and bookkeeping firms alike.

This blog is aimed to spread awareness about compliance with the FTC rules.

Understanding the FTC Safeguards Rule: Why Should You be Concerned?

The FTC Safeguards Rule outlines specific requirements for covered financial institutions to safeguard customer information. Yours could be a company of accountants and bookkeepers, and still be under the purview of the FTC rules. Compliance with the rules is not just a legal obligation but a fundamental aspect of maintaining trust and credibility with clients.

The FTC Safeguards Rule covers financial institutions within the jurisdiction of the FTC. It also covers those financial institutions that do not fall under the purview of the Gramm-Leach-Bliley Act. To clarify, the Gramm-Leach-Bliley Act mandates that financial institutions (companies that offer consumers financial products or services like loans, financial or investment advice, or insurance, etc.) must explain their information-sharing practices to their customers and to safeguard sensitive data.

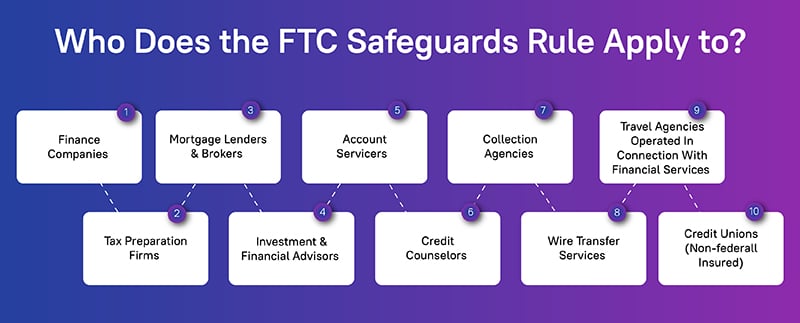

The FTC Safeguards Rule is mandatory for businesses such as mortgage lenders, brokers, motor vehicle dealers, payday lenders, finance companies, account servicers, check cashing firms, wire transfer services, collection agencies, credit counselors, financial advisors, tax preparers, non-federally insured credit unions, and investment advisors not mandated to register with the SEC fall under this scope. However, this list isn’t comprehensive, so it’s crucial to determine if your entity is covered.

Is Your Business Compliant? The FTC Safeguards Rule Provisions Checklist

An amendment to the FTC Safeguards Rule would now also require non-banking institutions to report certain data breaches and other security events to the agency. This means non-banking financial institutions, such as mortgage brokers, motor vehicle dealers, and payday lenders, will also need to develop, implement, and maintain a comprehensive security program to keep their customers’ information safe.

Other provisions of the FTC Safeguard Rule include the need for financial institutions to notify the FTC as soon as possible, and no later than 30 days after discovery, of a security breach involving the information of at least 500 consumers. In the case of unencrypted customer information being obtained without consent of the respective customer or individuals to whom it belongs, the business or institution holding this information needs to notify the FTC. Notifications to the FTC would also require additional information such as the number of people affected, or potentially affected.

Some general provisions of the Rule include, but not cover all of them:

1. Appointing a Skilled Individual: To deploy and monitor an Information Security Program (ISP) to ensure effective data security.

2. Conducting Periodic Risk Assessments: To identify potential vulnerabilities and threats to customer information.

3. Documenting Risk Assessments: To reflect evolving risks and operational changes.

4. Implementing Specific Safeguards: From access controls and data encryption to multifactor authentication and incident response planning, firms must implement a robust framework of safeguards to protect customer data comprehensively.

While exceptions exist for institutions with fewer than 5,000 consumers, it’s crucial not to overlook the significance of implementing comprehensive security measures regardless of thresholds.

The Challenge of Ensuring Compliance

Complying with the Safeguards Rule can be challenging, especially for firms who may be unfamiliar with data security protocols. Understanding the data lifecycle—from collection to disposal—is central to addressing security gaps effectively.

Taking a Proactive Approach

Compliance with the FTC Safeguards Rule can be challenging. Consulting with experts can help:

- Understand compliance requirements and address them accordingly

- Deploy action to enable compliance, which means consulting with IT professionals for system changes, legal counsel for guidance, and industry experts who can interpret the legal requirements for your business operations

- Help troubleshoot matters, if needed

Data Security Awareness and Preparedness: A Modern Necessity

Data breaches continue to increase year-on-year with a 20% increase in data breaches from 2022 to 2023, according to Harvard Business Review. Given the increased risk of data breaches encountered by businesses, failure on their part to invest in proactive cybersecurity can lead to financial losses, and damage to reputation and sustainability.

Furthermore, data breaches come at a high cost. Sources say the average cost of a data breach in 2024 is estimated to be $4.5 million, which represents a 12% increase from the year 2020. The financial impact of cybersecurity incidents only serves to highlight the need for more robust preventive measures that businesses must take.

Data security concerns also underscore the need for urgency of compliance with FTC Safeguards Rule.

Adhering to FTC Safeguards Rule

Compliance with the FTC guidelines can help businesses ensure sustainability as well as financial security. A proactive approach, collaborating with experts to ensure compliance, and leveraging technology with the help of experts can help businesses stay abreast of evolving security trends.

Adhering to the FTC guidelines also safeguards customer interests for compliant businesses, thus helping uphold higher standards of both data safety and best business practices.

Schedule Your Free Consultation now to learn more about how you can weave in the FTC regulations in your practice, especially when it comes to data collection, data handling, security and monitoring, etc.