Today, eCommerce is undoubtedly the fastest-growing sector. However, it is also a very saturated industry filled with many giant, high-powered, and reputable firms. It is also rife with bitter rivalry and stiff competition. This means eCommerce websites must be technically robust to improve the customer experience and journey throughout the buying process.

Typical online stores today require dozens of essential modules. Nevertheless, an essential feature of an online store today is a straightforward checkout process. In this blog, we will discuss one of the most crucial elements of the checkout process—the best payment gateway. First, let’s explain what a payment gateway is:

Payment Gateway: A Quick Overview!

A payment gateway is a third-party service that bridges a customer, the online store, and a bank (i.e., a payment processor). Integrating a website or an app makes it feasible to make or accept online payments, which helps verify transaction credentials and authorize fund transfers between buyers and sellers.

Why is Choosing the Best Payment Gateway Important?

According to Statista, the overall transaction value in the digital payment sector was estimated to reach $8.49 trillion by 2022. A 12.31% CAGR is anticipated by 2027, when the total transaction value is projected to be about $15.17 trillion.

Building an effortless consumer journey requires selecting an efficient payment gateway for your eCommerce platform. A payment gateway integrates into your company’s cloud infrastructure and is often a third-party online store application. This makes the information flow more easily so your customers can make purchases using their preferred payment methods, such as a credit or debit card. Moving ahead, let’s discuss the following:

Top Features and Benefits of The Best Payment Gateway!

The key features and benefits of the best eCommerce payment gateway include the following:

- A good payment gateway can reduce the number of instances of shopping cart abandonment that poor in-store experiences, technological difficulties, or a lack of payment options bring about.

- Access to customer payments is simple and smooth for brick-and-mortar businesses, online enterprises, and eCommerce stores.

- As a method of fraud detection, many advanced payment gateways perform velocity pattern analysis. This involves examining recurrent transaction patterns within a predetermined timeframe to prevent their occurrence or, if necessary, to alert the card owner.

- Maintain the confidentiality of client data and any money paid through the system.

- By offering a high level of encryption, reputable and trustworthy payment gateways deter fraud and the theft of funds while gaining the trust of their clients.

Now that you’ve seen the features and benefits of having the best payment gateways, let’s move forward and discuss the following:

Top Payment Gateways for Your eCommerce Business!

Here is a list of the top payment gateways:

#1. PayPal

With more than 220 million active accounts globally, PayPal is undoubtedly the most popular payment system. PayPal, which was established in 1998, allows international payment processing. PayPal also accepts credit cards and offers payment processing services to online retailers, auction sites, and other businesses worldwide.

#2. Amazon Pay

Customers can access a safe and straightforward payment service through Amazon, a leading eCommerce payment gateway. To complete registration and verification, it only uses the information users have already provided in their Amazon account. With a single sign-in, Amazon users can instantly complete transactions on websites and mobile apps after getting authorization.

#3. Stripe

Stripe is yet another robust payment gateway explicitly made for online businesses. Billions of dollars’ worth of transactions are handled annually through Stripe. In addition to supporting mobile payment providers, Stripe accepts all standard payment methods. Stripe supports over a hundred different currencies, including features like one-click payments, subscription billing, and mobile payments. A dashboard also helps users view transactions on a single screen. Although Stripe is feature-rich, setting it up is much more complicated than other gateways.

#4. Authorize.net

Founded in 1996, Authorize.net is yet another well-known payment gateway. You can receive payments from websites and rapidly transfer money to your bank account with Authorize.net. Now that we’ve discussed the top payment gateways, let’s look closely at choosing the best gateway for your eCommerce site.

#5. Apple Pay

Apple Pay is renowned for working with Apple devices and smartphones for in-person and online purchases from an eCommerce store. It simply takes one tap to use Apple Pay on an iPhone or iPad, making it easy to use. Apple Pay is also compatible with traditional credit and debit card issuers like MasterCard, Visa, AmericanExpress, and many more. Also, to stop fraud and unlawful activity, Apple Pay uses NFT technology.

#6. Skrill

The UK-based eCommerce payment gateway Skrill is perfect for businesses operating in high-risk sectors. With Skrill, connecting to any international bank account is simple. It is one of the most cost-effective payment gateways appropriate for dropshipping and smaller enterprises, with a cost of 1.2% for each transaction. Skrill enables eCommerce customers to make purchases anywhere easily and supports over 30 currencies. Additionally, giving users a free account is also a valuable feature.

#7. Google Pay

Making transactions simple and worthwhile is Google Pay’s top priority. Some of the biggest industry giants utilize this eCommerce payment gateway and primarily focus on eCommerce stores, mobile apps, and in-person checkouts.

Your eCommerce platform can quickly and easily accept payments with Google Pay. However, you can do it yourself or get help from a reputable eCommerce development company.

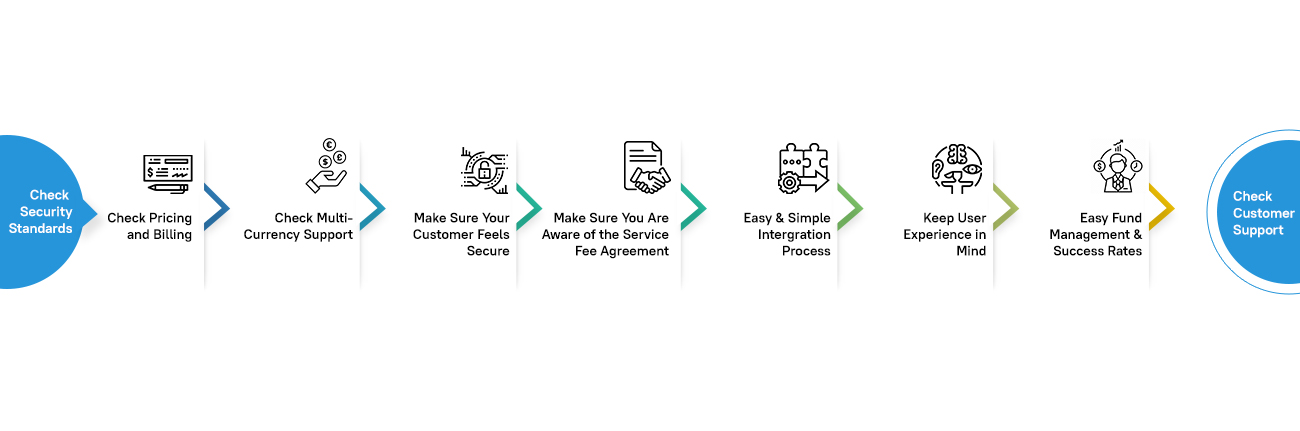

Choosing the Best Payment Gateway for E-commerce—Key Tips:

Today, choosing the best payment gateway for your eCommerce website can be challenging. However, you may find the following tips helpful:

#1. Check Security Standards

The security of transaction data is one of the most significant challenges for an eCommerce business. Thus, your online payment gateway must come with several security safeguards by default.

Different payment gateways use various levels of protection. It is your responsibility to pick a product that always preserves the privacy of your customer data. A secured payment gateway makes use of a level-1 PCI DSS-compliant vendor. However, you may require a PCI DSS 3.0-certified company with a strong data security culture.

#2. Check Pricing and Billings

Pricing and billing policies for different payment gateways can vary significantly. Most services charge a flat rate per transaction or a percentage of the total amount. Other services permit yearly or monthly subscriptions. Companies should select the most economical billing method for their specific situation based on the type of eCommerce process they choose.

Remember, there are other fees aside from transaction and subscription fees that eCommerce sites may face. Additionally, some providers may demand payment for setup, management, or other similar services.

#3. Multi-Currency Support

A payment gateway is crucial to expand your eCommerce businesses internationally. The gateway should be able to handle various currencies with ease. It is crucial to give your consumers the option to pay conveniently in their own currency without having to deal with complicated exchange rates. Ideally, it would help if you searched for a payment gateway that can process transactions in all the major currencies (dollar, euro, pound sterling, yen, Mexican peso, etc.). This will help you to be more future-proof and globally competitive.

#4. Keep User Experience in Mind

Most of today’s customers favor mobile apps over desktop programs. Because of this, it is crucial to choose an eCommerce payment gateway that works flawlessly on mobile and desktop platforms.

#5. Easy & Simple Integration Process

Make sure your website can integrate. Before selecting a payment gateway service, it’s crucial to know what integration solutions are available because integrating a payment gateway shouldn’t take up a lot of resources. Most payment gateways include open integration documentation that can provide documentation of the procedure and integration choices.

#6. Make Sure You Are Aware of Service & Fees Agreements

Consider the cost and the need for a service agreement before selecting a payment gateway. Prices and service agreement requirements vary slightly across each payment gateway. As a result, before choosing the payment gateway, verify both.

#7. Easy Fund Management & Success Rates

A reliable payment gateway offers users speedy payment processing. However, it is also crucial for firms to get their money quickly. Check the settlement duration when selecting a payment gateway for your eCommerce store to ensure a seamless cash flow. You can successfully manage refunds and cashback with quick payment settlements.

#8. Check Customer Support

Your business will be able to enhance the customer experience and bring about a few advantages, such as enhanced brand loyalty, by choosing the right payment gateway that gives round-the-clock service. In addition, it enables you to respond quickly to the demands of your customers and provide support. The best part is that receiving round-the-clock assistance from payment gateway providers helps boost your business’s reputation and sales.

#9. Make Your Customers Feel Secure

Nowadays, customers demand websites that use the safest payment methods. Make sure your payment gateway is entirely secure, and never compromise the safety of your online payment systems. It ought to secure all your customer’s credit card and transaction information. Utilizing state-of-the-art technical tools will lessen the risk of fraud. Check to see if the company offering the payment gateway has received certification for adhering to information security standards like PCI-DFF and others.

Conclusion

Many payment gateways are available but finding and integrating the one that best suits your needs is essential. Before making the final decision, it’s necessary to consider the qualities and advantages that each of them has to offer. Alternatively, you might want a web development company with extensive experience integrating payment gateways for your eCommerce website.

Next Steps

- If you need any further assistance with integrating a payment gateway or are looking forward to eCommerce web development, we can help.

- We are a leading eCommerce development services provider with 15+ years of experience with all the leading technologies.

- Email us at sales@analytix.com or call 781.503.9003 today.

- Follow our blog for industry trends and the latest updates.

- Engage with us on LinkedIn and Twitter.